The 20-Second Trick For Personal Loans Canada

Table of ContentsThe Basic Principles Of Personal Loans Canada Some Ideas on Personal Loans Canada You Need To KnowThe Greatest Guide To Personal Loans CanadaThe Basic Principles Of Personal Loans Canada The Best Guide To Personal Loans Canada

Allow's study what a personal car loan really is (and what it's not), the factors individuals use them, and exactly how you can cover those crazy emergency situation expenditures without handling the worry of financial debt. An individual lending is a round figure of cash you can borrow for. well, almost anything.That does not include borrowing $1,000 from your Uncle John to assist you pay for Xmas presents or letting your roomie area you for a couple months' rent. You should not do either of those points (for a variety of reasons), however that's practically not a personal funding. Individual car loans are made with a real financial institutionlike a financial institution, credit score union or on the internet lending institution.

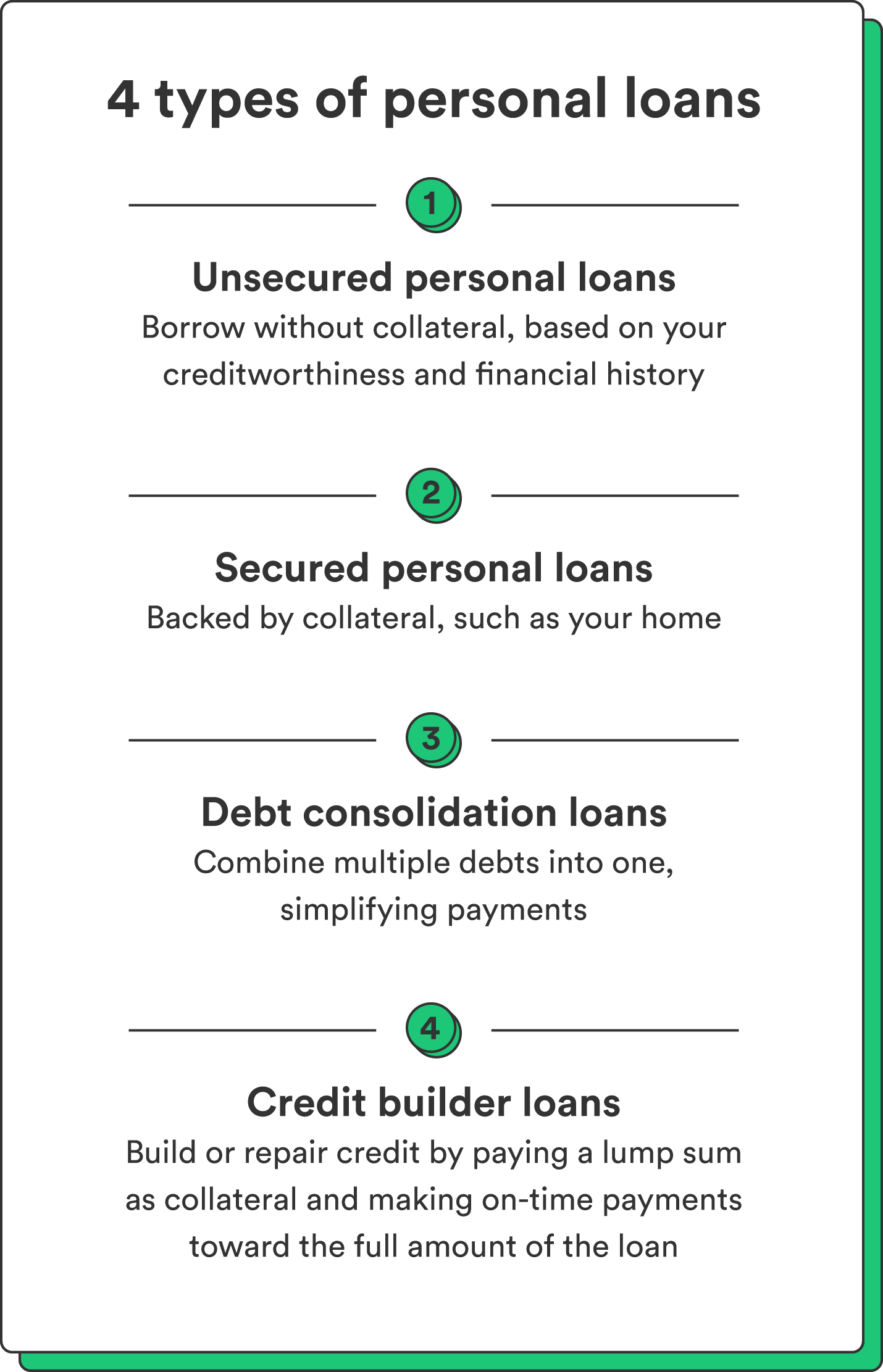

Allow's take an appearance at each so you can understand exactly just how they workand why you do not need one. Ever.

The smart Trick of Personal Loans Canada That Nobody is Discussing

Shocked? That's okay. Despite how great your credit rating is, you'll still have to pay passion on most personal car loans. There's always a rate to pay for obtaining money. Safe personal financings, on the other hand, have some sort of security to "safeguard" the lending, like a boat, precious jewelry or RVjust to name a couple of.

You could also get a protected individual financing utilizing your vehicle as collateral. That's a hazardous step! You do not desire your main mode of transportation to and from work obtaining repo'ed since you're still spending for last year's cooking area remodel. Depend on us, there's nothing safe concerning guaranteed financings.

Just because the repayments are predictable, it does not indicate this is an excellent deal. Personal Loans Canada. Like we claimed in the past, you're virtually ensured to pay passion on an individual funding. Simply do the math: You'll wind up paying means much more in the future by securing a financing than if you would certainly just paid with cash money

Things about Personal Loans Canada

And you're the fish holding on a line. An installment lending is an individual funding you pay back in taken care of installments gradually (usually as soon as a month) up until it's paid in full - Personal Loans Canada. check my site And do not miss this: You need to pay back the initial lending quantity before you can borrow anything else

Do not be mistaken: This isn't the very same as a credit scores card. With personal lines of credit scores, you're paying rate of interest on the loaneven if you pay on time. This type of lending is incredibly difficult due to the fact that it makes you assume you're managing your debt, when really, it's handling you. Payday advance.

This set obtains us provoked up. Why? Because these organizations exploit individuals who can't pay their bills. And that's just incorrect. Technically, these are temporary finances that offer you your income beforehand. That may seem hopeful when you're in a monetary accident and require some money to cover your costs.

Unknown Facts About Personal Loans Canada

Why? Due to the fact that points obtain real unpleasant genuine quickly when you miss a repayment. Those creditors will certainly come after your sweet grandma who guaranteed the car loan for you. Oh, and you should never cosign a finance for any person else either! Not only can you get stuck with a loan that was never ever suggested to be yours in the first area, but it'll spoil the relationship prior to you can state "compensate." Depend on us, you don't wish to get on either side of this sticky circumstance.

All you're really doing is utilizing brand-new financial debt to pay off old financial debt (and expanding your funding term). That just indicates you'll be paying much more with time. Firms understand that toowhich is specifically why numerous of them offer you debt consolidation loans. A lower rates of interest does not obtain you out of debtyou do.

And it begins with not obtaining anymore cash. ever before. This is a good general rule for any type of monetary purchase. Whether you're considering taking out an individual car loan to cover that cooking area remodel or your overwhelming credit score card bills. don't. Getting debt to spend for things isn't the method to go.

The Greatest Guide To Personal Loans Canada

And if you're taking into consideration an individual car loan to cover an emergency situation, we get it. Borrowing money to pay for an emergency situation just rises the tension and hardship of the scenario.

Comments on “The 7-Minute Rule for Personal Loans Canada”